http://www.flickr.com/photos/gentleman_rook/ / CC BY-ND 2.0

How can you save money on motorcycle insurance? Pam King, who writes about such things for Direct General, a company dealing in motorcycle insurance, contacted me to ask if she could do a guest post here discussing that question. After reading her piece I told her yes, but that I would be adding my own comments in a few spots where I take a different view of the matter.

10 Simple Questions for Cheaper Motorcycle Insurance

Whether you’ve just purchased your first motorcycle or have been riding for years, motorcycle insurance can make a HUGE impact on your budget. As with auto insurance, your rates will depend on things like your age, the type of bike you own, your driving record, and your geographic location.

Aside from these factors, there are several other ways you can save money on your motorcycle insurance. All it takes is knowing the right questions to ask! Here are 10 questions to ask your insurance agent and potentially save yourself quite a bit of money on your policy.

1) Do you have a detailed copy of your current policy? If you currently have a motorcycle insurance policy, having it in front of you when talking to your agent can be a big help. The agent will want to know the specifics of your current coverage and how much you pay for each portion. This can help them determine the best rate – and hopefully save you money in the end.

2) Does your state require bodily injury coverage? Many locations require you to have bodily injury coverage, which pays for injury to others if the accident is your fault. In most states, the legal minimum is $10,000 per person, per accident. However, insurance companies recommend you carry as much as three times the minimum in case of litigation or a lawsuit.

Ask your insurance agent for the specifics of their policy, but as a rule, bodily injury coverage pays for the medical bills incurred by injured parties and their guests, the cost of repairing or replacing damaged property, the lost wages of the injured party, and more.

3) Can you afford to increase your deductible? Increasing your deductible, the amount you pay for a claim before insurance kicks in, is a great way to lower your monthly payments. Having a higher deductible will cost more if you get into an accident, but it can save you quite a bit of money from month-to-month. If you do increase your deductible, you may want to consider putting part of the money you save each month into a savings account. Then, this can be saved in case of a future accident.

Ken says: I hear this all the time and I personally take a different approach. Yes, you can reduce your monthly premium if you take a higher deductible, but if you have a single claim in 5 years or even more, what you save with the lower deductible can easily more than pay the extra premium amount. I can deal with paying a few dollars extra each month. I don’t want to get hit with that BIG expense all at once in case I have a claim.

4) Do you plan to ride with a guest? Unlike auto insurance, passengers aren’t automatically covered under a policy. If you plan on riding with guest — and this means ever — you’ll want to add guest passenger liability coverage to your policy. This will pay for any injuries your passenger gets while riding with you.

5) Do I need collision coverage? Take a look at the following factors. If any apply to you, you may want to consider dropping your collision coverage:

Your bike is more than five years old

Your bike is valued at less than $3,000

You’re a safe driver and haven’t had an accident in the last years

You’ve saved enough money to pay for repairs if needed

Talk with your insurance agent before you decide to drop it completely. They can help you determine if this is a good choice based on your deductibles and the value of your motorcycle.

Ken says: Both my bikes are more than 5 years old and I say yes to the other points except that my Concours is worth more than $3,000. I carry only liability on my Honda CB750 but I have collision on my Connie. The reason is the bodywork on the Connie. That stuff is expensive. Coupled with my low deductible, an accident that does not total the bike but causes serious damage would not cost me much, and it would more than justify my choices for a lot of years.

6) Do you need all the extras? Motorcycle insurance plans sometimes include things like roadside assistance, extra medical coverage, and towing. Sit down and consider whether or not you can live without these items, or if the money you’ll save by dropping them is worth it.

Ken says: This should be a no-brainer. Don’t pay extra for roadside assistance or towing: join the American Motorcyclist Association and get these at no extra charge as part of your membership, provided that you sign up for automatic renewal each year via credit card.

7) Do you want accessory or custom parts coverage? Some policies don’t cover the extras you add to your bike, even if they are damaged or destroyed in an accident. This includes things like highway pegs, radios, CBs, custom seats, a luggage rack, safety guards, and more. If you want coverage for these, be sure to add it to your policy. If you can live without it, don’t opt for the coverage and save yourself some money each month.

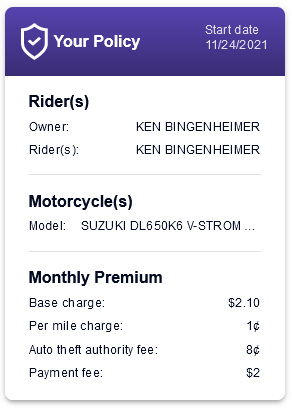

8) Do you plan to drive your bike to work? If not, let your insurance agent know. Some companies give discounts for putting less than a certain number of miles on your bike each year. Quite the opposite, others give discounts for using your bike for transportation to and from work. Of course, this will be something you’ll have to bring up with your agent to get the appropriate discount.

9) Do you live in a low-cost or high-cost area? If you plan to move in the near future or garage your bike in a different area than you live (For example, a vacation home), make sure to tell your agent this. Generally, the more urban the area you live, the higher your premium. And, rates can vary significantly from state to state. If your winters are spent in Arizona, but your bike is stored at home in South Dakota, your rates may be significantly different.

10) Do all drivers on your policy use the motorcycle? This is particularly important for young drivers. If you have a student who’s moved away to college and no longer drives the motorcycle, drop them from your policy. Why? Because the insurance rates are much higher for teens. However, be cautious–if you take a driver off your policy but they eventually take your bike out for a joy ride and have an accident, you’ll be liable for everything.

There you go, my friends. Consider the above questions before talking with your insurance agent about motorcycle insurance coverage. It will not only help you be well-informed, but will also help negotiate the best rates and save money in the long run.

About the Author:

Pam King writes on frugality, safety and insurance literacy for Direct General, a motorcycle insurance provider. When not saving money on her insurance, Pam enjoys knitting, NASCAR, family and watching rollerderby! :)

Recent from National Motorcycle Examiner

Helmets reduce cervical spine injury in crashes, study says

Biker Quote for Today

Sweat wipes off. Road-rash doesn’t.